MSC Certification

in the UK

Motivations and market benefits

In 2020, the MSC commissioned NEF Consulting to explore the social and economic benefits experienced by UK fisheries as a result of becoming MSC certified

The study looked at changes to the price of fish before and after certification, as well as interviewing fishery stakeholders. It focused on two UK fisheries: Cornish hake and Cornish sardine.

The results reveal preliminary evidence of price premiums as a result of MSC certification as well as benefits relating to market access and reputation.

Scroll down to dive deeper...

INTRODUCTION

From the icy seas of the southern ocean to the waters that lap European shores, MSC certification has driven ecological benefits to marine environments around the world.

There is growing evidence that certification can benefit the fisheries and fishermen committing to sustainability too, as well as to the wholesalers, processors and retailers further along the supply chain. However these benefits can sometimes be more difficult to measure. This is because many different market forces are at play, all influencing the availability, demand and value of seafood.

In 2020, the MSC commissioned NEF Consulting of the New Economics Foundation (NEF) to explore the potential socioeconomic impacts that occur as a result of MSC certification.

The research focused on two UK fisheries: Cornish hake and Cornish sardine.

NEF aimed to understand whether the two fisheries had experienced price premiums, price stability, increased sales or improved market access since becoming MSC certified.

BACKGROUND

The two fisheries

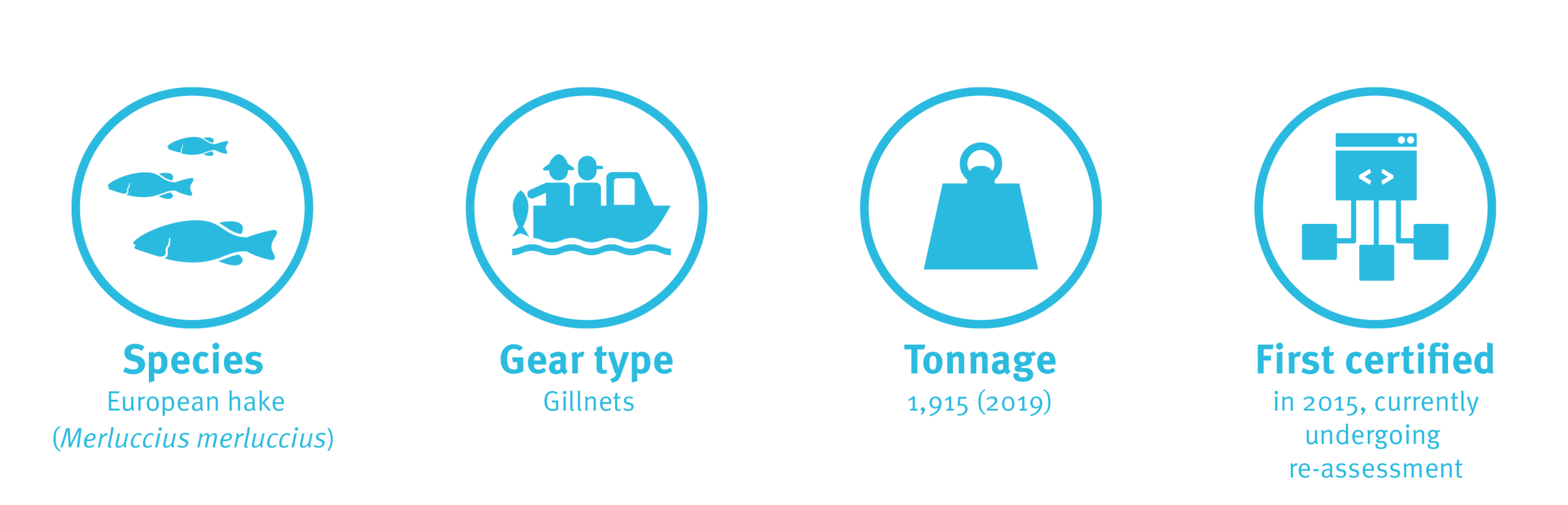

1. The Cornish hake gillnet fishery

The Cornish hake fishery consists of a fleet of 15 boats catching hake in the Celtic Sea to the west of the UK mainland and south of Ireland. It’s managed by the Cornish Fish Producers Organisation Ltd., a non-profit cooperative, and first received MSC certification in 2015.

The fishery lands just under 2,000 metric tons of European hake per year into Newlyn, Cornwall with fish sold at neighbouring fish markets in Brixham, Plymouth and Newlyn.

The main end-market for Cornish hake is in Europe, particularly Spain, France and the UK. Fish are sold as fresh, whole, gutted fillets and steaks into retail and restaurants.

The initial drivers for MSC certification were improved marketability of the catch, greater market access, and improved pricing.

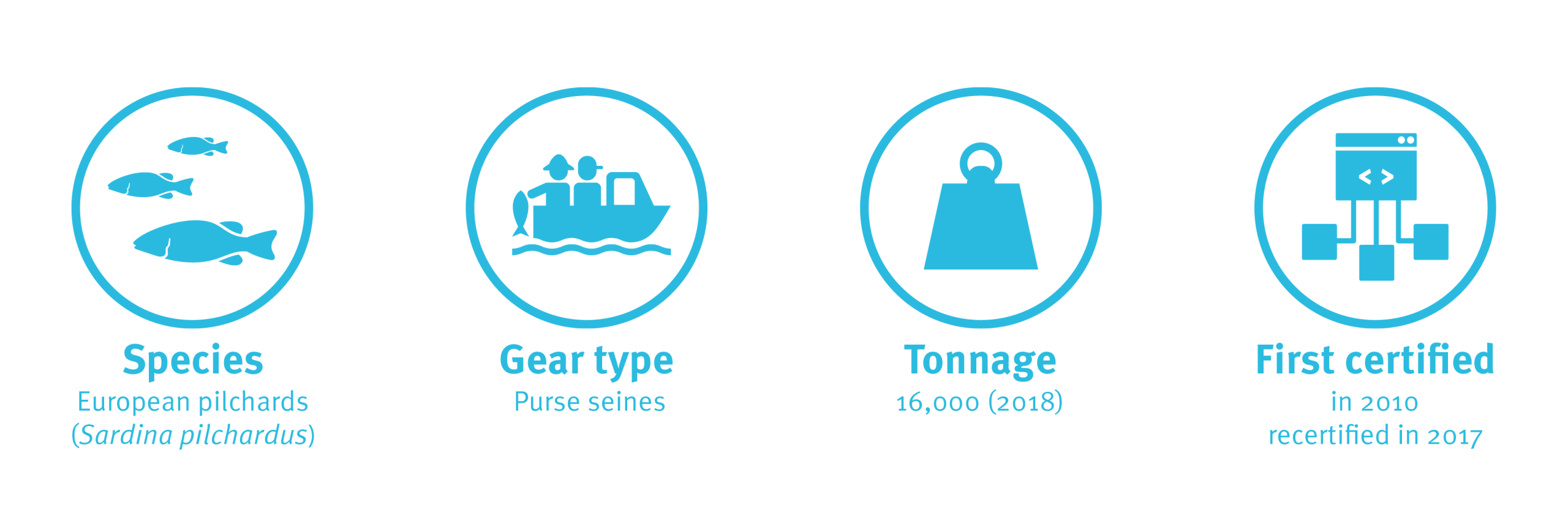

2. The Cornish sardine fishery

The Cornish sardine fishery consists of 15 small boats catching sardines with purse seine nets. The season usually begins in July with the arrival of the sardines in Cornish waters, and lasts until January.

Vessels put to sea from Newlyn, Mevagissey and Plymouth and fish traditional grounds within six nautical miles of land. Once caught, the sardines are put on ice to optimise freshness and quality, and sold to fish processors or merchants either at a fish market or directly from the vessel.

The fishery is run by the Cornish Sardine Management Association, a partnership between the owners of the 15 vessels, and four local seafood processors. The members collectively catch and process almost all of the sardines caught in the area.

METHODS

What did NEF do?

NEF combined two approaches to explore socioeconomic benefits in the two fisheries.

- A desk-based economic analysis exploring changes to the price of seafood pre- and post-certification.

- A social survey comprising interviews with fisheries, wholesalers, vessel owners, producer organisations, skippers and management bodies involved in both the hake and sardine fisheries.

Part 1: Comparing prices

NEF first set about exploring whether fisheries reap a higher price (a ‘price premium’) for MSC-certified fish. To do this, they compared changes in prices and landings volume of MSC-certified fish before and after certification to a ‘control group’ of the same fish species caught elsewhere in the UK, but not certified.

For the Cornish hake fishery, the control group selected was the average of the four largest hake landings to ports in Scotland: Lochinver, Ullapool, Peterhead, and Scrabster. Together with Newlyn (where Cornish hake is landed), these represent the UK’s five largest ports for hake landing.

Identifying a control group for the Cornish sardine fishery was more challenging due to a lack of sardine fisheries elsewhere in the UK. Sardines landed in Dutch ports by UK-registered vessels were therefore used as a proxy.

While there are different factors influencing prices between these two groups (e.g. different markets), a comparison between each group was deemed appropriate for an indicative exploration of price differences.

NEF used economic modelling to explore trends in the relationship between the two pairs of fisheries.

Part 2: Social survey

In addition to exploring changes in price, interviews were conducted with fishers, wholesalers, vessel owners, producer organisations, skippers and management bodies involved in both the hake and sardine fisheries to understand their experiences of MSC certification.

Fifteen fishery stakeholders were interviewed in total. Of these, five were involved in the hake fishery (representing 33% of the 15 vessels certified) and 11 in the sardine fishery (78% of the vessels) with one fisher involved in both fisheries.

Questions covered the certification process itself, the social and economic benefits that stakeholders had anticipated receiving as a result of certification, as well as those that were realised once the fishery had become certified.

RESULTS

Does MSC certification influence quayside prices?

CORNISH HAKE

Between 2008 and 2019, landings of hake increased considerably, growing from 206 tonnes in 2008 to 1,727 tonnes in 2019, a jump of 740%.

The total value of Cornish hake landings increased in tandem, jumping from £690k to £4.7m over the same period, a rise of 580%.

Hake’s price per kilogram has fluctuated due to market pressures.

Between 2012 and 2015, Cornish and Scottish (control group) hake fisheries had similar prices per kilogram, with Cornish hake consistently lower than Scottish hake.

At the time of certification, the average price of Cornish hake was 75% of the price being received by the Scottish group.

The price of Cornish hake rose following the fishery’s certification in 2015...

...while the price of Scottish hake fell over the same period.

By the end of 2018, the price of Cornish hake was 138% that of the non-certified Scottish hake fisheries, suggesting a marked increase in quayside prices since certification.

NEF’s economic models confirmed that MSC certification was a significant driver of the increasing quayside price of hake.

CORNISH SARDINE

Sardine landings have increased considerably across Cornish ports (Falmouth, Newlyn, Mevagissey, Plymouth, and Fowey) since 2008 with a sharp rise in tonnes landed between 2010 and 2011 and again between 2015 and 2016.

Over the same period, the price of sardines fluctuated greatly, both in the MSC-certified Cornish fishery as well as for Dutch-landed UK sardines (the control group).

MSC certification does not appear to influence Cornish sardine prices. This may be because the supply of sardines increased greatly during this period of time, keeping the price per kilogram down.

RESULTS

What other social and economic benefits were experienced?

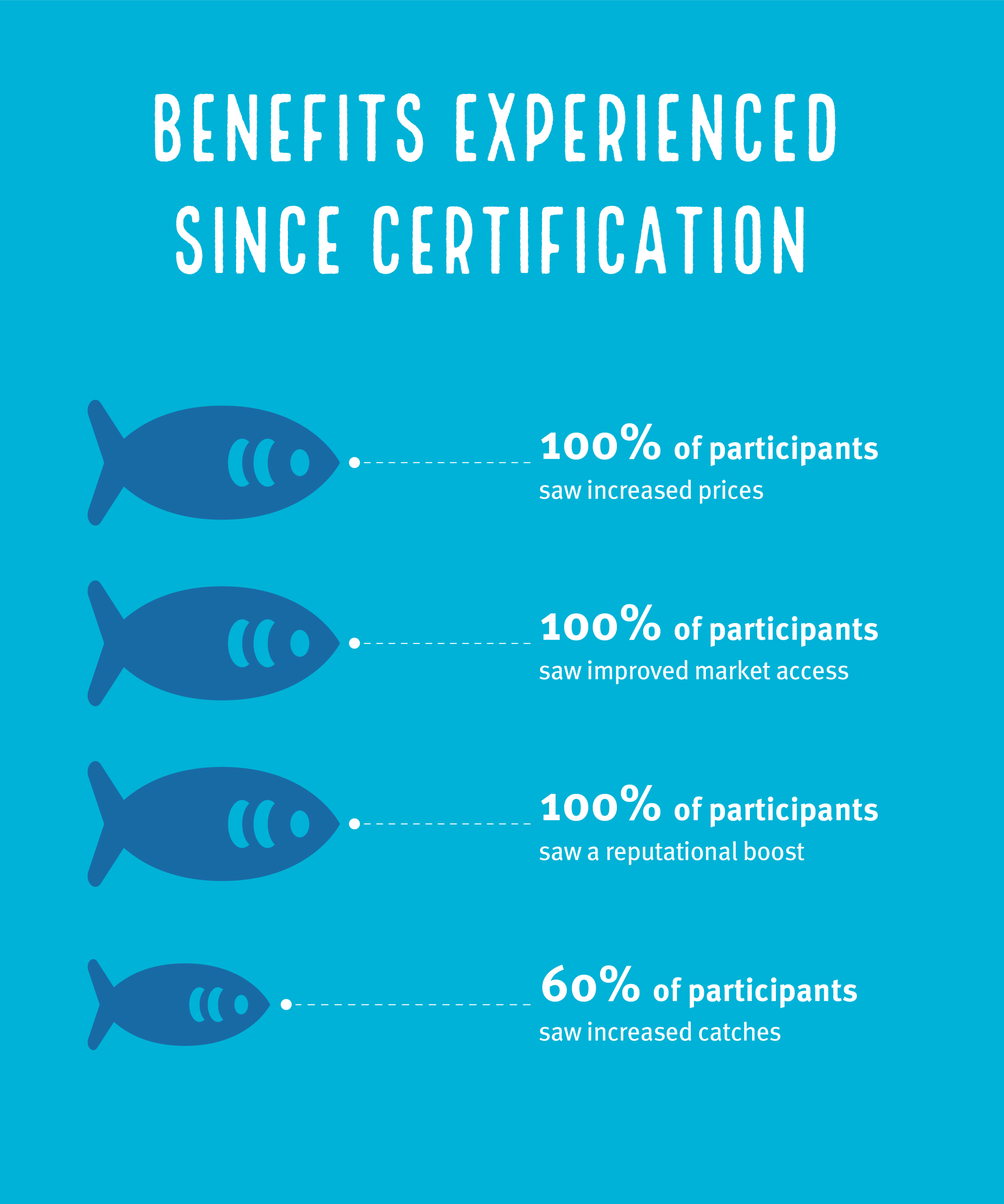

Cornish Hake

Price premiums (60%) and the chance to sell to supermarkets (40%) ranked highly in interviewees motivations for pursuing MSC certification. Interviewees were also motivated by the reputational boost that they believed MSC certification could offer.

All of the stakeholders interviewed thought that the benefits of certification had outweighed the costs associated with the assessment process.

The benefits that they had realised since becoming certified included an increase in price (100%), improved market access (100%), and a reputational boost (100%).

Three quarters of those interviewed (80%) said they were satisfied with the benefits they were experiencing as a result of MSC certification, in particular the fact that prices had risen and the volume of landings had been maintained.

In addition to certification itself, improvements in product quality care, staggered landings of fish for the market, increased consumer demand and MSC publicity (including TV chef endorsement) were also thought to have contributed to price premiums in the fishery.

Interviewees believed that a marketing campaign by MSC had resulted in a 60p rise in price per kg.

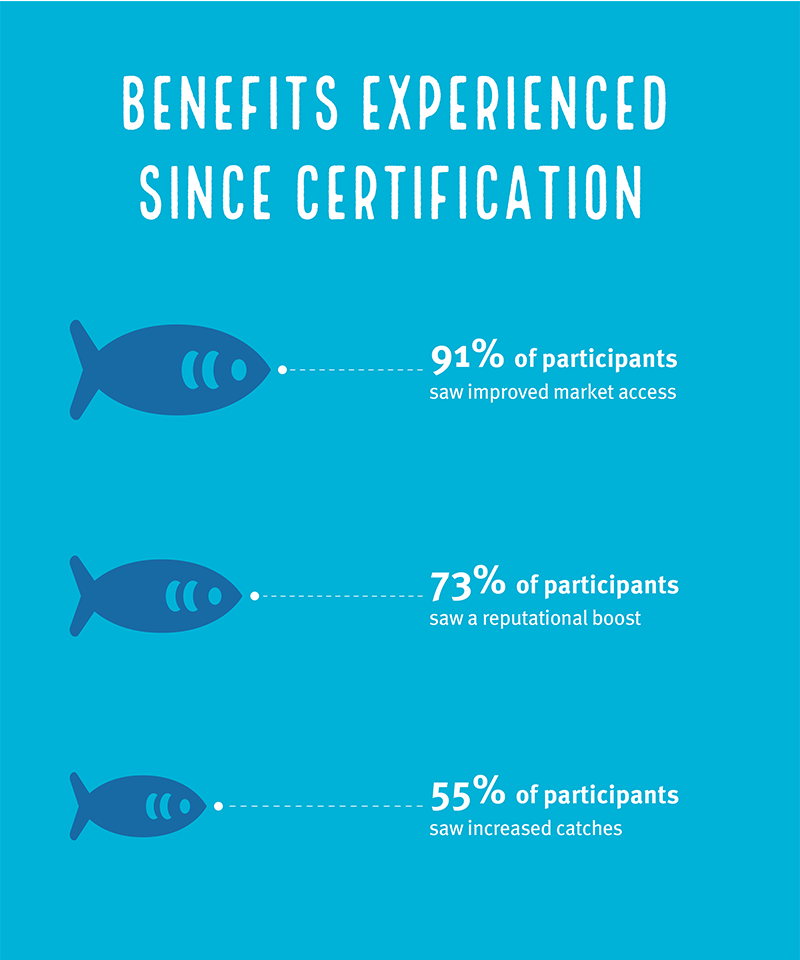

Cornish Sardine

Reputational benefits (54%) and access to more (27%) and larger (36%) markets were the most common motivations for pursuing MSC certification while two interviewees (18%) were motivated by the potential to gain a price premium.

All of the stakeholders interviewed (100%) said that the benefits of certification outweighed the cost of the process and once certified, most stakeholders (91%) thought market access had improved with over half of them (54%) attributing this to MSC certification.

The ability to sell MSC-certified butterfly fillets as well as whole fish was seen as a particularly important new market opportunity.

Most of those interviewed (73%) felt that the fishery’s reputation had improved as a result of certification with increased awareness of MSC through marketing and TV programmes also playing a role.

Other benefits that interviewees mentioned following certification included more fish reaching the marketplace (54%), improvements in quality control (36%) and a greater number of export markets (27%).

Despite the price fluctuations, the majority of those interviewed (82%) said that prices had stayed the same after MSC certification.

And while there doesn't appear to be an increase in price relative to the control group, the increase in sardine landings after certification has meant fishers have maintained their gross income.

CONCLUSION

The findings of this study provide valuable insights into the wider economic and social impacts of MSC certification in the UK. They show preliminary evidence of a price premium as well as benefits to market access and reputation.

By choosing seafood with the blue fish ecolabel, consumers are not only helping to protect the oceans, but the livelihoods of the fishermen who have made commitments to operate sustainably too.